Discover insights into the dietary supplement consumer—CRN's COVID-19 and 2020 surveys now available for purchase

For over 20 years, the CRN Consumer Survey on Dietary Supplements has served as a leading source for data on the attitudes and behaviors of the dietary supplement consumer. In light of COVID-19, CRN issued a separate survey focused on supplement usage throughout the ongoing pandemic. Read on for highlights and topline results of both the COVID-19 and 2020 consumer surveys. Contact Holly Vogtman for more information.

COVID-19 survey reveals subset of supplement users increasing intake throughout pandemic

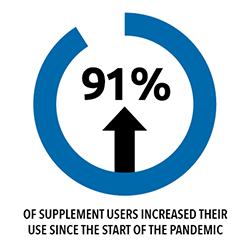

The COVID-19 survey discovered that more than two in five, or 43%, of supplement users have changed their supplement routine since the start of the pandemic. Among those who changed their regimens, 91% report increasing their supplement intake.

Total exceeds 100% as survey respondents could provide more than one answer

CRN's COVID-19 Consumer Survey on Dietary Supplements

Stock shortages and store closures among purchasing challenges consumers face throughout pandemic

Limited product availability due to the pandemic has resulted in more than a quarter of supplement users reporting they bought a different brand of dietary supplement and one in five switching from a branded product to a generic/store brand product according to results of the COVID-19 survey. Supplement users also experienced difficulties purchasing supplements from their usual retailer because of stock shortages and store closures. Men, those with children living at home, and younger adults were most likely to report difficulties purchasing supplements.

- 16% of users were unable to purchase dietary supplements from their usual retailer due to store closures

- 22% were unable to purchase supplements from their usual retailer due to stock shortages

- 27% had to buy a different brand of dietary supplements due to limited product availability/visiting a different store

- 21% had to switch from a branded product to a generic/store brand product due to limited product availability

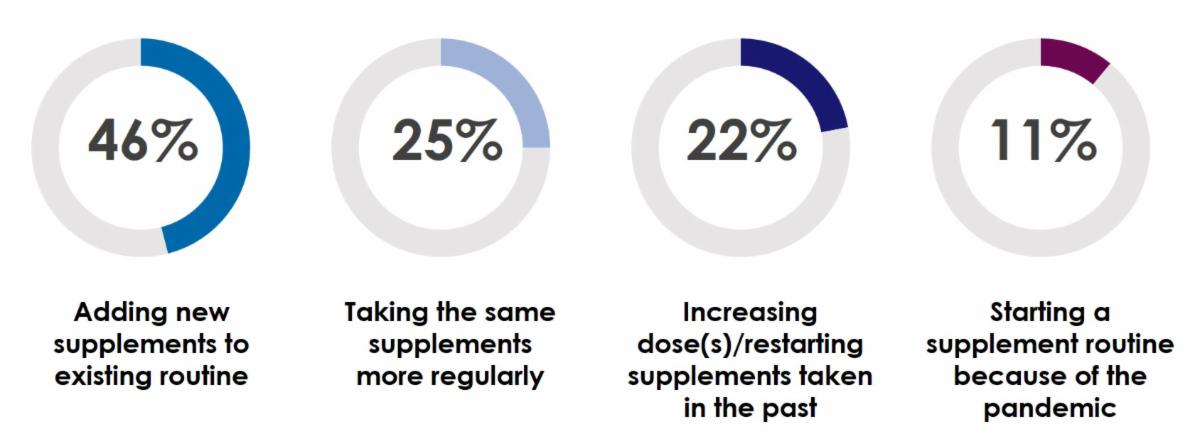

Where do supplement users purchase dietary supplements?

In line with previous years, data from the 2020 CRN Consumer Survey demonstrate that the majority of supplement purchases continue to be from mass markets, particularly at mass merchandisers, like Walmart or Target, and from pharmacies, like CVS, Walgreens or Rite-Aid.

2020 CRN Consumer Survey on Dietary Supplements

Supplement users under the age of 55 are more likely to visit less common mass market options, including health food stores or supermarkets, independent pharmacies, dollar stores, department stores, gyms, and convenience stores. This year’s results demonstrate a slight uptick in supplement purchases at warehouse clubs like Sam’s Club or Costco, but purchases at specialty vitamin retailer/chain health food stores notably declined.

Preferences for online shoppers in 2020

On par with 2019 results, 24% of supplement users cite purchasing supplements online. Of those online shoppers, nearly three quarters report buying supplements from Amazon. One third of online shoppers also report purchasing supplements from "other online retailers" like target.com or iherb.com. This purchasing option has gained significant traction in 2020 with 32% of online users reporting this option compared to 22% in 2019.

On par with 2019 results, 24% of supplement users cite purchasing supplements online. Of those online shoppers, nearly three quarters report buying supplements from Amazon. One third of online shoppers also report purchasing supplements from "other online retailers" like target.com or iherb.com. This purchasing option has gained significant traction in 2020 with 32% of online users reporting this option compared to 22% in 2019.

Purchasing supplements from Amazon is particularly popular for online shoppers who are male; under the age of 55; those living in urban areas; and parents with children in the household. Amazon purchases are also particularly high for those who take sports nutrition and/or weight management supplements.

2020 survey demonstrates focused interest for vitamins and minerals, reveals specific reasons for taking probiotics

Multivitamins are by far the most commonly used supplement across all demographics, with 54% of adults, including three quarters of supplement users having taken a multivitamin in the last year.  More than one third of supplement users also report taking vitamin D or vitamin C in the past 12 months.

More than one third of supplement users also report taking vitamin D or vitamin C in the past 12 months.

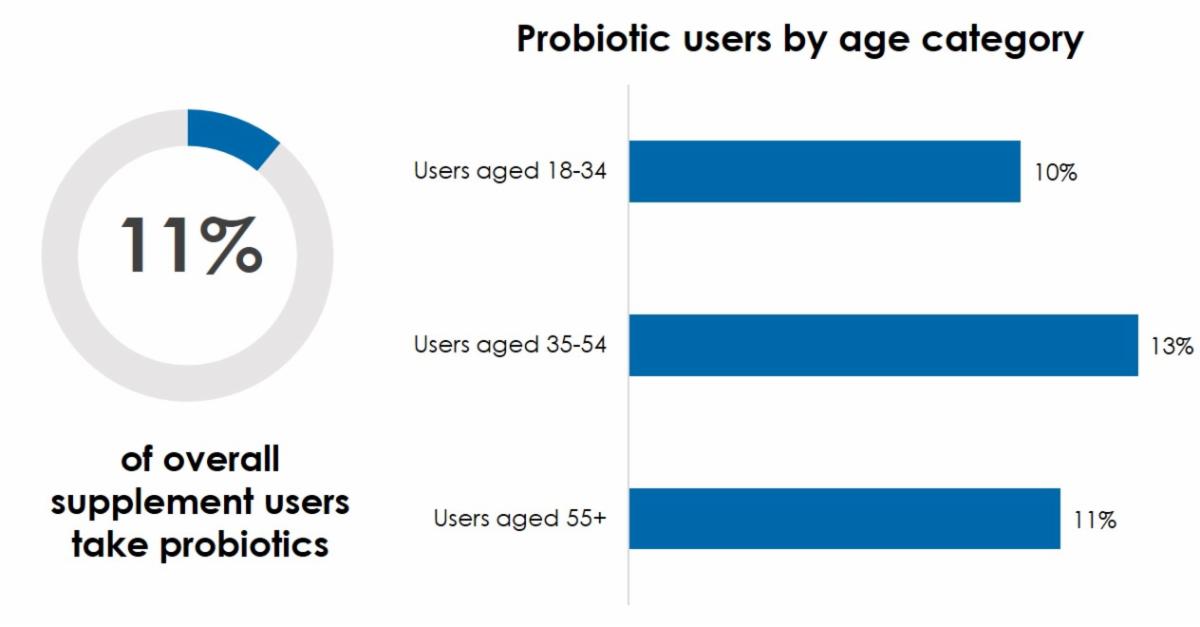

In the specialty supplement category, omega 3/fatty acids and probiotics are the most widely used supplements. New this year, the survey asks supplement users who report taking probiotics to cite their reasons for taking this ingredient. Among probiotic users, a majority (57%) say they take this ingredient for GI support or general health and 51% take these products to support immune health.

2020 CRN Consumer Survey on Dietary Supplements

Coming soon—CRN Probiotics Retailer Education Campaign

CRN is developing an initiative to help educate retail buyers on the intricacies of probiotic products—most importantly, storage and handling best practices, labeling probiotic quantity, and claims.  Given today's litigious environment, the increase in probiotic product innovation, and the advancement of science demonstrating increased benefit for probiotics, it is more important than ever that buyers understand these complexities to ensure they purchase high-quality probiotics products from responsible manufacturers.

Given today's litigious environment, the increase in probiotic product innovation, and the advancement of science demonstrating increased benefit for probiotics, it is more important than ever that buyers understand these complexities to ensure they purchase high-quality probiotics products from responsible manufacturers.

The initiative, launching later this fall, will include a "Retail Buyer's Guide to Probiotics" to educate retailers (buyers, quality assurance teams, pharmacists and dietitians) and other retail stakeholders on probiotics to help them better curate their offerings, improve their handling of these products, and educate their customers of their benefits. CRN will also provide buyers with probiotic sales and consumer data figures (drawn from our existing survey data) to further help buyers make informed decisions about what types of probiotics to store on their shelves in order to meet the growing consumer demand.

QUESTIONS ABOUT NEED TO KNOW?

Please contact Holly Vogtman (hvogtman@crnusa.org).