SEPTEMBER 29, 2020

Non-bank financing options provide lifeline to essential companies in these times

Dietary supplement companies form an essential industry that consumers depend on more than ever during the COVID-19 pandemic, which 85% of Americans report is a reminder to take care of their overall health, according to a recent CRN survey.

Dietary supplement companies form an essential industry that consumers depend on more than ever during the COVID-19 pandemic, which 85% of Americans report is a reminder to take care of their overall health, according to a recent CRN survey.

Companies that need capital in these times, but face senior lenders either too busy or too risk-averse in this environment, can find financing via non-bank options and avoid issuing equity at potentially lower valuations.

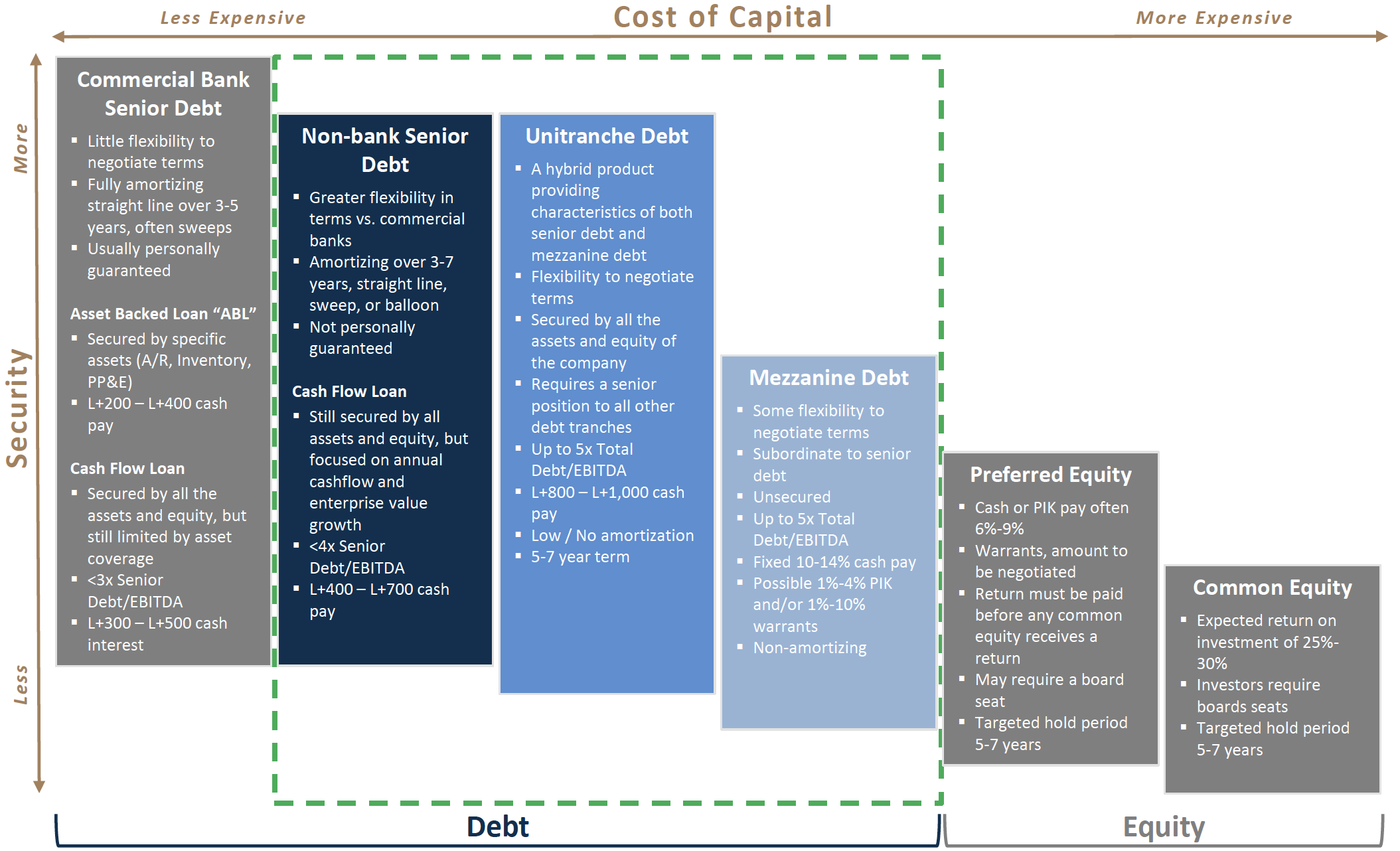

Private company financing options available to the lower middle market can often provide greater flexibility for cashflow and enterprise value growth.

Lower/Middle Market Capital Structure Products

Download chart, courtesy of Columbia West.

Download chart, courtesy of Columbia West.

These financing options can be smart choices for:

- Growing companies needing financing despite the current debt capital markets challenges

- Distressed companies who have defaulted on a bank loan and require an immediate solution

- Companies who need financing to facilitate a partial exit for a departing owner/manager

- Companies seeking to capitalize on this troubled market by buying competitors

Non-bank lenders offer greater flexibility in terms and availability of capital, but are more expensive than commercial banks. Most prefer candidates who generate at least $5 million EBITDA (pre-COVID) and seek to borrow at least $10 million.

Working for you: major-market investment banking experience and capabilities

Columbia West is proud to be a leading investment bank to Health and Wellness companies, offering dedicated coverage and custom financial advisory solutions including M&A advisory, capital raising and strategic financial advisory.

Columbia West is proud to be a leading investment bank to Health and Wellness companies, offering dedicated coverage and custom financial advisory solutions including M&A advisory, capital raising and strategic financial advisory.

Our dedicated Senior Health and Wellness Team delivers major-market investment banking experience and capabilities with the energy and focused attention of an entrepreneurial firm.

CW brings unparalleled value to a transaction process and access to capital, with extensive experience and relationships with strategic and financial investors. We understand that transactions in the lower middle market must achieve the goals of both the company as well as its owners and managers.

To discuss current market conditions for M&A sale transactions or capital raising for Health and Wellness companies, contact John Farr (480-664-3949 / jfarr@columbiawestcap.com). Columbia West is a registered FINRA (formerly NASD) Broker-Dealer and all principals are licensed by FINRA.

Learn more:

www.columbiawestcap.com/health-wellness